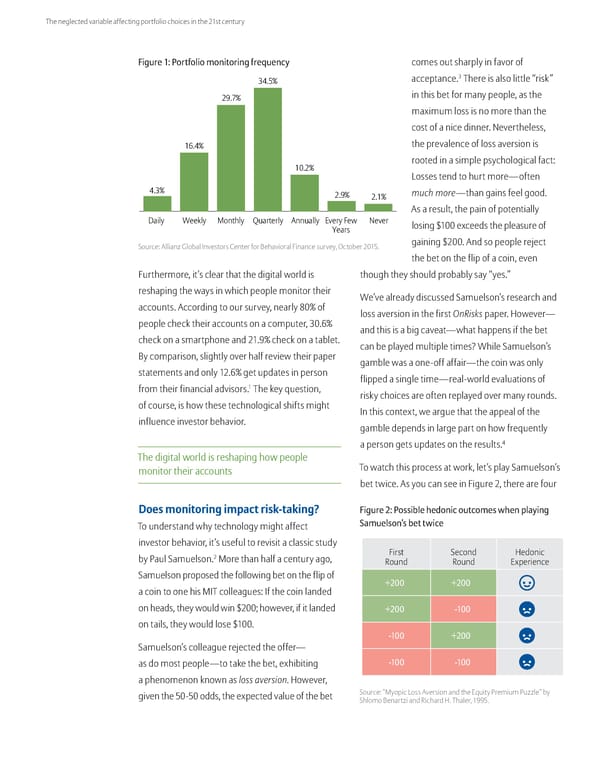

The neglected variable affecting portfolio choices in the 21st century Figure 1: Portfolio monitoring frequency comes out sharply in favor of 34.5% acceptance.3 There is also little “risk” 29.7% in this bet for many people, as the maximum loss is no more than the cost of a nice dinner. Nevertheless, 16.4% the prevalence of loss aversion is 10.2% rooted in a simple psychological fact: Losses tend to hurt more—often 4.3% 2.9% 2.1% much more—than gains feel good. As a result, the pain of potentially Daily Weekly Monthly Quarterly Annually Every e ever losing $100 exceeds the pleasure of ear Source: Allianz Global Investors Center for Behavioral Finance survey, October 2015. gaining $200. And so people reject the bet on the flip of a coin, even Furthermore, it’s clear that the digital world is though they should probably say “yes.” reshaping the ways in which people monitor their We’ve already discussed Samuelson’s research and accounts. According to our survey, nearly 80% of loss aversion in the first OnRisks paper. However— people check their accounts on a computer, 30.6% and this is a big caveat—what happens if the bet check on a smartphone and 21.9% check on a tablet. can be played multiple times? While Samuelson’s By comparison, slightly over half review their paper gamble was a one-off affair—the coin was only statements and only 12.6% get updates in person flipped a single time—real-world evaluations of 1 from their financial advisors. The key question, risky choices are often replayed over many rounds. of course, is how these technological shifts might In this context, we argue that the appeal of the influence investor behavior. gamble depends in large part on how frequently 4 a person gets updates on the results. The digital world is reshaping how people monitor their accounts To watch this process at work, let’s play Samuelson’s bet twice. As you can see in Figure 2, there are four Does monitoring impact risk-taking? Figure 2: Possible hedonic outcomes when playing To understand why technology might affect Samuelson’s bet twice investor behavior, it’s useful to revisit a classic study by Paul Samuelson.2 More than half a century ago, First Second Hedonic Round Round Experience Samuelson proposed the following bet on the flip of +200 +200 a coin to one his MIT colleagues: If the coin landed on heads, they would win $200; however, if it landed +200 -100 on tails, they would lose $100. -100 +200 Samuelson’s colleague rejected the offer— as do most people—to take the bet, exhibiting -100 -100 a phenomenon known as loss aversion. However, given the 50-50 odds, the expected value of the bet Source: “Myopic Loss Aversion and the Equity Premium Puzzle” by Shlomo Benartzi and Richard H. Thaler, 1995.

The Neglected Variable Affecting Portfolio Choices in the 21st Century Page 2 Page 4

The Neglected Variable Affecting Portfolio Choices in the 21st Century Page 2 Page 4