Econs, Humans, and the Perception of Risk

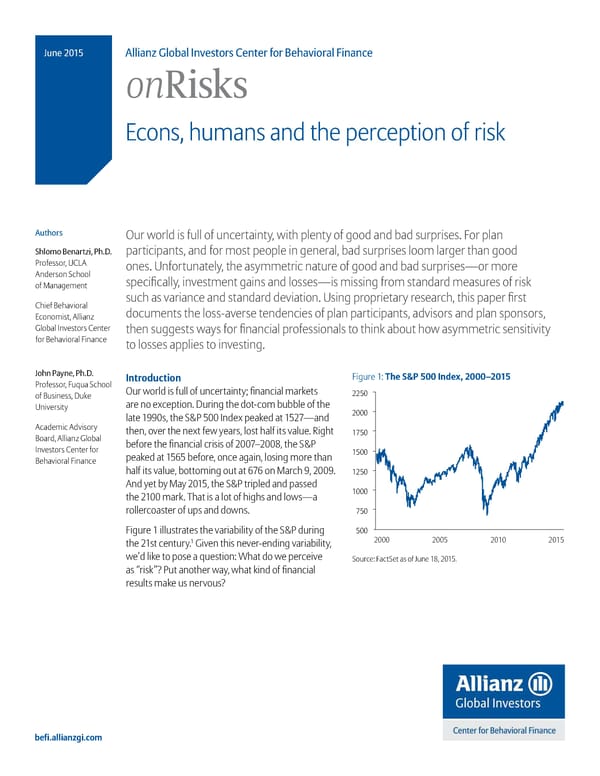

June 2015 Allianz Global Investors Center for Behavioral Finance onRisks Econs, humans and the perception of risk Authors Our world is full of uncertainty, with plenty of good and bad surprises. For plan Shlomo Benartzi, Ph.D. participants, and for most people in general, bad surprises loom larger than good ‚rofessor, Uš›Œ ones. Unfortunately, the asymmetric nature of good and bad surprises—or more Œnderson chool specifically, investment gains and losses—is missing from standard measures of risk of ‹anagement šhief œehavioral such as variance and standard deviation. Using proprietary research, this paper first Economist, Œllianž documents the lossaverse tendencies of plan participants, advisors and plan sponsors, ‘lobal „nvestors šenter then suggests ways for financial professionals to think about how asymmetric sensitivity for œehavioral Finance to losses applies to investing. John Payne, Ph.D. Introduction Figure ” The S&P 500 Index, 2000–2015 ‚rofessor, Fu“ua chool Our world is full of uncertainty financial markets of œusiness, uke 2250 University are no eception. uring the dotcom bubble of the late s, the €‚ ƒ „nde peaked at ƒ…†—and 2000 Œcademic Œdvisory then, over the net few years, lost half its value. ‡ight 1750 œoard, Œllianž ‘lobal before the financial crisis of … †–… ‰, the €‚ „nvestors šenter for peaked at ƒŠƒ before, once again, losing more than 1500 œehavioral Finance half its value, bottoming out at Š†Š on ‹arch , … . 1250 Œnd yet by ‹ay … ƒ, the €‚ tripled and passed 1000 the … mark. Žhat is a lot of highs and lows—a rollercoaster of ups and downs. 750 Figure illustrates the variability of the €‚ during 500 2000 2005 2010 2015 the …st century. ‘iven this neverending variability, we’d like to pose a “uestion” •hat do we perceive ource” Factet as of ™une ‰, … ƒ. as “risk”˜ ‚ut another way, what kind of financial results make us nervous˜ befi.allianzgi.com

Econs, Humans, and the Perception of Risk Page 2

Econs, Humans, and the Perception of Risk Page 2