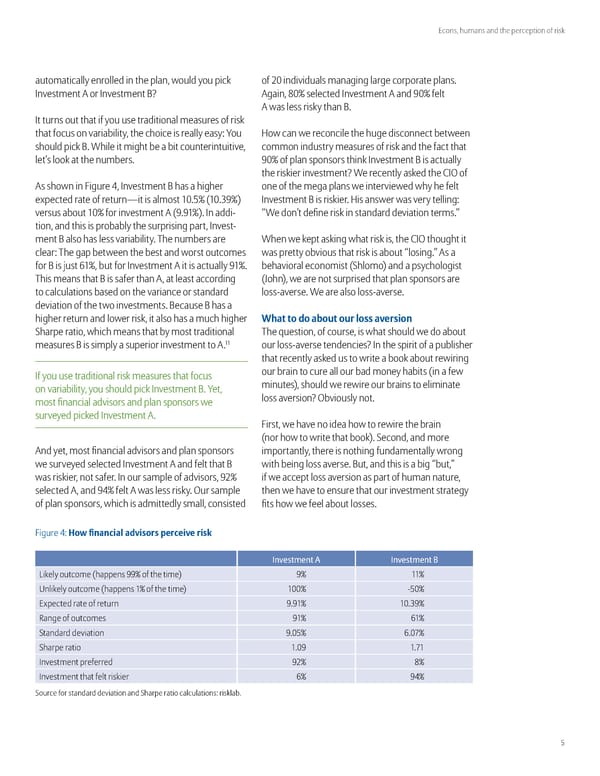

Econs, humans and the perception of risk automatically enrolled in the plan, would you pick of … individuals managing large corporate plans. „nvestment Œ or „nvestment œ˜ Œgain, ‰ ¡ selected „nvestment Œ and ¡ felt Œ was less risky than œ. „t turns out that if you use traditional measures of risk that focus on variability, the choice is really easy” «ou ¬ow can we reconcile the huge disconnect between should pick œ. •hile it might be a bit counterintuitive, common industry measures of risk and the fact that let’s look at the numbers. ¡ of plan sponsors think „nvestment œ is actually the riskier investment˜ •e recently asked the š„O of Œs shown in Figure §, „nvestment œ has a higher one of the mega plans we interviewed why he felt epected rate of return—it is almost .ƒ¡ ¨ .£¡© „nvestment œ is riskier. ¬is answer was very telling” versus about ¡ for investment Œ ¨.¡©. „n addi “•e don’t define risk in standard deviation terms.” tion, and this is probably the surprising part, „nvest ment œ also has less variability. Žhe numbers are •hen we kept asking what risk is, the š„O thought it clear” Žhe gap between the best and worst outcomes was pretty obvious that risk is about “losing.” Œs a for œ is ¥ust Š¡, but for „nvestment Œ it is actually ¡. behavioral economist ¨hlomo© and a psychologist Žhis means that œ is safer than Œ, at least according ¨™ohn©, we are not surprised that plan sponsors are to calculations based on the variance or standard lossaverse. •e are also lossaverse. deviation of the two investments. œecause œ has a higher return and lower risk, it also has a much higher What to do aout our loss a‚ersion harpe ratio, which means that by most traditional Žhe “uestion, of course, is what should we do about measures œ is simply a superior investment to Œ. our lossaverse tendencies˜ „n the spirit of a publisher that recently asked us to write a book about rewiring „f you use traditional risk measures that focus our brain to cure all our bad money habits ¨in a few on variability, you should pick „nvestment œ. «et, minutes©, should we rewire our brains to eliminate most financial advisors and plan sponsors we loss aversion˜ Obviously not. surveyed picked „nvestment Œ. First, we have no idea how to rewire the brain ¨nor how to write that book©. econd, and more Œnd yet, most financial advisors and plan sponsors importantly, there is nothing fundamentally wrong we surveyed selected „nvestment Œ and felt that œ with being loss averse. œut, and this is a big “but,” was riskier, not safer. „n our sample of advisors, …¡ if we accept loss aversion as part of human nature, selected Œ, and §¡ felt Œ was less risky. Our sample then we have to ensure that our investment strategy of plan sponsors, which is admittedly small, consisted fits how we feel about losses. Figure §” o financial ad‚isors ercei‚e ris Investment A Investment B ›ikely outcome ¨happens ¡ of the time© ¡ ¡ Unlikely outcome ¨happens ¡ of the time© ¡ ƒ ¡ Epected rate of return .¡ .£¡ ‡ange of outcomes ¡ Š¡ tandard deviation . ƒ¡ Š. †¡ harpe ratio . .† „nvestment preferred …¡ ‰¡ „nvestment that felt riskier Š¡ §¡ ource for standard deviation and harpe ratio calculations” risklab.

Econs, Humans, and the Perception of Risk Page 4 Page 6

Econs, Humans, and the Perception of Risk Page 4 Page 6