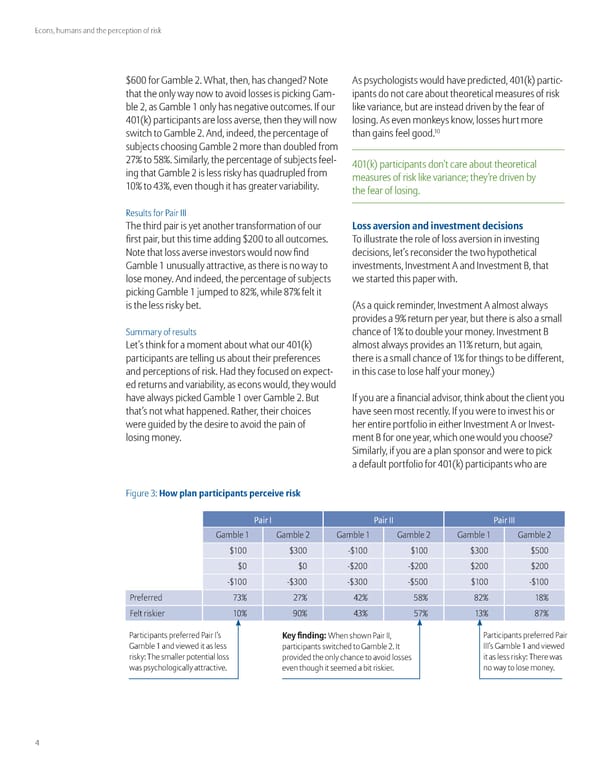

Econs, humans and the perception of risk ¤Š for ‘amble …. •hat, then, has changed˜ ¢ote Œs psychologists would have predicted, § ¨k© partic that the only way now to avoid losses is picking ‘am ipants do not care about theoretical measures of risk ble …, as ‘amble only has negative outcomes. „f our like variance, but are instead driven by the fear of § ¨k© participants are loss averse, then they will now losing. Œs even monkeys know, losses hurt more switch to ‘amble …. Œnd, indeed, the percentage of than gains feel good. sub¥ects choosing ‘amble … more than doubled from …†¡ to ƒ‰¡. imilarly, the percentage of sub¥ects feel § ¨k© participants don’t care about theoretical ing that ‘amble … is less risky has “uadrupled from measures of risk like variance they’re driven by ¡ to §£¡, even though it has greater variability. the fear of losing. ‡esults for ‚air „„„ Žhe third pair is yet another transformation of our €oss a‚ersion and in‚estment decisions first pair, but this time adding ¤… to all outcomes. Žo illustrate the role of loss aversion in investing ¢ote that loss averse investors would now find decisions, let’s reconsider the two hypothetical ‘amble unusually attractive, as there is no way to investments, „nvestment Œ and „nvestment œ, that lose money. Œnd indeed, the percentage of sub¥ects we started this paper with. picking ‘amble ¥umped to ‰…¡, while ‰†¡ felt it is the less risky bet. ¨Œs a “uick reminder, „nvestment Œ almost always provides a ¡ return per year, but there is also a small ummary of results chance of ¡ to double your money. „nvestment œ ›et’s think for a moment about what our § ¨k© almost always provides an ¡ return, but again, participants are telling us about their preferences there is a small chance of ¡ for things to be different, and perceptions of risk. ¬ad they focused on epect in this case to lose half your money.© ed returns and variability, as econs would, they would have always picked ‘amble over ‘amble …. œut „f you are a financial advisor, think about the client you that’s not what happened. ‡ather, their choices have seen most recently. „f you were to invest his or were guided by the desire to avoid the pain of her entire portfolio in either „nvestment Œ or „nvest losing money. ment œ for one year, which one would you choose˜ imilarly, if you are a plan sponsor and were to pick a default portfolio for § ¨k© participants who are Figure £” o lan articiants ercei‚e ris Pair I Pair II Pair III ‘amble ‘amble … ‘amble ‘amble … ‘amble ‘amble … ¤ ¤£ ¤ ¤ ¤£ ¤ƒ ¤ ¤ ¤… ¤… ¤… ¤… ¤ ¤£ ¤£ ¤ƒ ¤ ¤ ‚referred †£¡ …†¡ §…¡ ƒ‰¡ ‰…¡ ‰¡ Felt riskier ¡ ¡ §£¡ ƒ†¡ £¡ ‰†¡ ‚articipants preferred ‚air „’s ƒey finding •hen shown ‚air „„, ‚articipants preferred ‚air ‘amble and viewed it as less participants switched to ‘amble …. „t „„„’s ‘amble and viewed risky” Žhe smaller potential loss provided the only chance to avoid losses it as less risky” Žhere was was psychologically attractive. even though it seemed a bit riskier. no way to lose money.

Econs, Humans, and the Perception of Risk Page 3 Page 5

Econs, Humans, and the Perception of Risk Page 3 Page 5